In today’s interconnected global economy, managing multinational operations poses unique challenges for enterprises. These challenges include coordinating diverse teams across multiple regions, navigating regulatory complexities, and ensuring alignment with strategic objectives. Enterprise Performance Management (EPM) solutions offer a comprehensive approach to address these complexities by integrating planning, budgeting, forecasting, and analytics into a unified framework. This blog explores how EPM solutions empower global enterprises to enhance operational efficiency, drive informed decision-making, and achieve sustainable growth across international markets.

Understanding Enterprise Performance Management (EPM)

Enterprise Performance Management (EPM) encompasses a set of integrated processes and methodologies designed to optimize the performance of an organization’s enterprise-wide activities. EPM solutions provide executives and stakeholders with actionable insights into financial performance, operational metrics, and key performance indicators (KPIs) through advanced analytics, real-time reporting, and strategic planning capabilities. By aligning operational execution with strategic goals, EPM enables enterprises to monitor performance, identify opportunities, and respond proactively to market dynamics and competitive pressures.

Key Benefits of EPM for Global Enterprises

- Alignment with Strategic Objectives: EPM facilitates alignment of business objectives and strategic initiatives with overarching revenue and cost goals within global enterprises. Long range plan helps organizations establish their 3 to 5 year vision and the key strategies and projects which will help them get there. Whereas AOP (annual operating plan) helps organizations to define annual revenue and cost priorities by regions, business units, or product/services. Both these processes can be modelled and inter-linked easily in EPM solutions. By defining clear business targets, milestones, and outcomes, global Enterprise Performance Managementt enables enterprises to focus resources and efforts on initiatives that drive business results, enhance market position, and foster sustainable growth across international markets and regions.

- Standardization, Consistency and Alignment: The complexity, scale, and cultural elements involved in managing business operations in diverse geographies can be varied. Organizations need to have a consistent business performance framework in order to define, manage and monitor the performance of all its multi-national entities across all of such elements. EPM solutions facilitate the adoption of standardized business definitions, common business vocabulary, metrics/KPIs, and processes across global enterprise operations. By establishing consistent budgeting, analysis and governance frameworks, EPM ensures uniformity in performance tracking, operational execution, and global benchmarking across diverse geographical locations and business units.

- Enhanced Collaboration and Communication: Effective communication and collaboration are fundamental to the success of global enterprise operations. EPM platforms provide centralized definition of business rules & assumptions (specific to different geos), common definitions, logics and formulae that enable understanding of business strategies and priorities among distributed teams. This capability fosters a collaborative culture, facilitates cross-functional alignment, and accelerates decision-making processes across different time zones and cultural boundaries.

- Optimized Resource Allocation and Utilization: Efficient resource management is critical for maximizing productivity and minimizing costs within global enterprises. EPM solutions offer robust planning functionalities that enable organizations to align capital, workforce, infrastructure, and production capacities effectively by region, business unit or products/services. By optimizing resource allocation based on real-time data and predictive analytics, enterprises can mitigate resource constraints, improve workforce productivity, and enhance operational efficiency across global units.

- Cross-Pollinating Best Practices & Processes: EPM supports continuous improvement initiatives by facilitating performance reviews, benchmarking exercises, and evaluations across multinational operations. EPM solutions enable global organizations to analyze performance trends across regions, identify what’s working at different units, figure out common areas for optimization, and implement corrective actions where performance is not meeting the plan. This helps large enterprises drive operational excellence, optimize costs, and enhance business processes & practices globally. This commitment to continuous improvement ensures resilience, agility, and long-term sustainability in a competitive global marketplace.

- Real-time Performance Monitoring and Reporting: EPM solutions provide real-time visibility into key performance metrics and operational insights through interactive dashboards, customizable reports, and ad-hoc analysis tools. This capability allows executives and managers to monitor performance against targets, track KPIs, and identify trends across diverse geographies and business functions. EPM solutions make it automatic for organizations to handle multi-currency, inter-company transactions, and complex allocations. Let’s say a company has operations in US, UK, and Japan with headquarters in India. Enterprise Performance Management software tools can represent the business financials to the US teams in US dollar, to the UK team in Sterling Pound, to the Japanese unit in Yen, while rolling up all the data in INR. By leveraging accurate and timely data, enterprises can make informed decisions, optimize operational efficiency, and drive continuous improvement initiatives globally.

Case Studies and Success Stories

Numerous global enterprises across various industries have successfully leveraged EPM solutions to achieve operational excellence and drive growth:

- Technology and IT Services: Leading technology firms use EPM to align workforce with dynamically changing skill requirements, develop optimum capacities, proactively plan headcount and costs, across worldwide development and delivery centres.

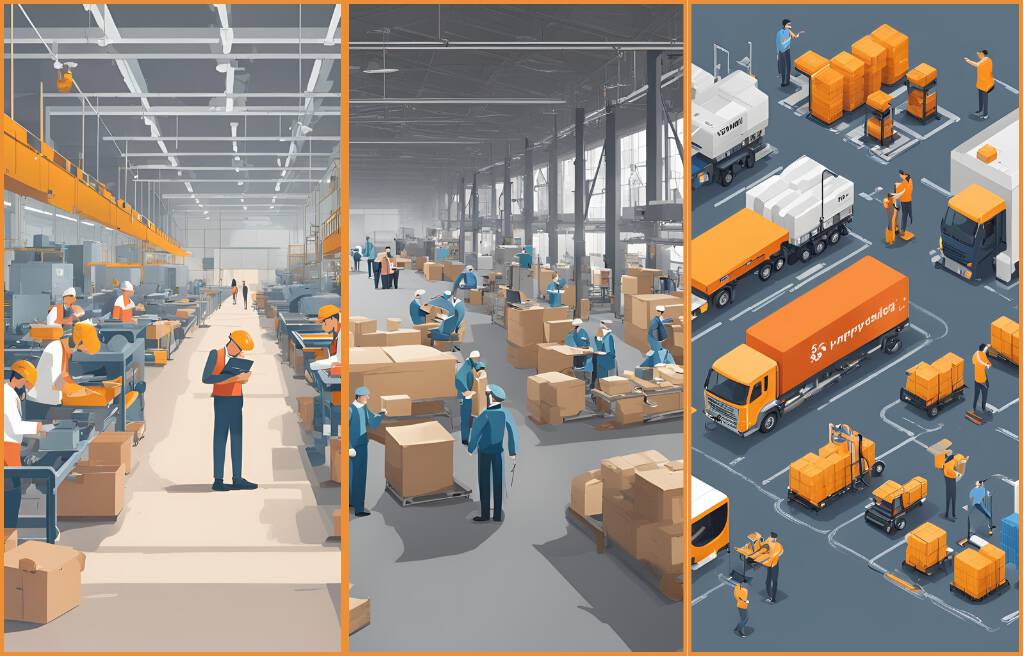

- Manufacturing: Manufacturing companies utilize EPM to optimize supply chain management, coordinate production schedules, and drive operational excellence across global manufacturing facilities and distribution networks.

- Financial Services: Leading banks and financial institutions use EPM to streamline financial planning and analysis (FP&A), optimize capital allocation, and enhance regulatory compliance across international subsidiaries and business units.

- Retail and Consumer Goods: Retail giants utilize EPM for demand forecasting, inventory management, and supply chain optimization to meet consumer demands, improve operational efficiency, and expand market presence globally.

Challenges and Considerations

While EPM offers significant advantages for global enterprises, successful implementation requires addressing several key challenges and considerations:

- Change Management and Organizational Alignment: Effective change management strategies are essential for overcoming resistance to new processes, gaining stakeholder buy-in, and fostering a culture of data-driven decision-making and performance accountability.

- Data Integration and Technology Infrastructure: Seamless integration of EPM solutions with existing IT systems, data warehouses, and enterprise applications ensures data accuracy, reliability, and interoperability across international operations.

- Cultural Diversity and Communication: Understanding cultural nuances, language barriers, technology orientation, and communication styles is crucial for promoting collaboration, teamwork, and knowledge sharing among multicultural teams and stakeholders.

- Regulatory Compliance and Legal Frameworks: Adhering to varying regulatory requirements, legal frameworks, and compliance standards in different countries poses significant adjustments for global companies.

Conclusion

In conclusion, Enterprise Performance Management (EPM) solutions play a pivotal role in helping global enterprises manage their multinational operations more effectively. By integrating strategic planning, performance monitoring, risk management, and collaboration capabilities into a unified framework, EPM empowers organizations to optimize performance, enhance decision-making, and achieve sustainable growth across diverse geographical regions and business functions.

Anaplan and Workday Adaptive Planning are two of the leading EPM solutions, used by more than 8000 organizations globally. If you are a multi-national organization, your Anaplan consultant or Workday Adaptive Planning consultant can help you leverage these leading tools to better manage your multi-geo business operations.

As global enterprises continue to navigate complex business landscapes and pursue growth opportunities in international markets, EPM remains a strategic imperative for driving operational excellence, maintaining competitiveness, and delivering value to stakeholders in a rapidly evolving global economy.